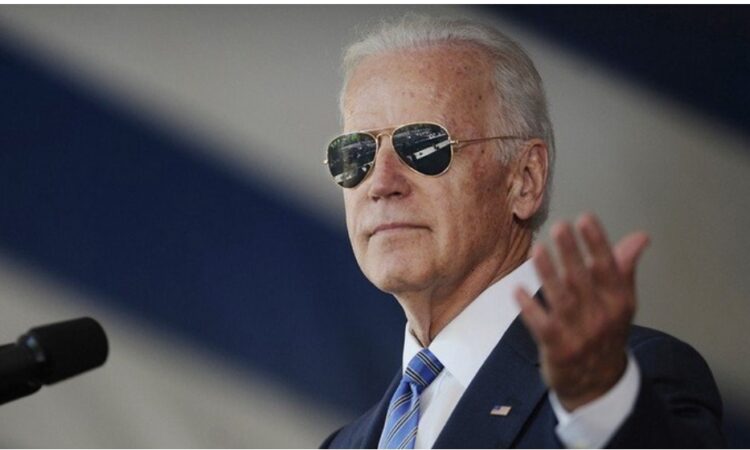

The Biden Economy — hailed Monday morning by Presidentish Joe Biden as “strong” — seems like it’s falling apart, everything, everywhere all at once. NYSE halted trading of Charles Schwab, whose shares fell by more than 20%, and even a few Etsy sellers have been impacted by the fallout of Silicon Valley Bank’s (SVB) collapse.

Schwab’s fall was the firm’s “most ever on an intraday-basis,” even as company execs assured investors in a press release that “Schwab’s long-standing reputation as a safe port in a storm remains intact.”

Overall, trading of shares in over 30 banks was halted on Wall Street Monday morning, as the entire sector suddenly looks like a risk investors aren’t willing to take. Almost everything banking was down, down, down in pre-market trades, which MarketWatch described as “panic-like activity.”

“Among some of those that have already been halted at least twice,” MarketWatch reported, “shares of Western Alliance Bancorp WAL, -51.05% plummeted 78.2%, Regions Financial Corp. RF, -5.33% sank 15.6%, First Republic Bank FRC, -64.05% plunged 65.5%, Comerica Inc. CMA, -21.24% tumbled 39.4% and PacWest Bancorp. PACW, -25.18% took a 47.7% dive.”

Signature Bank, “a key financial institution for the cryptocurrency industry,” according to the New York Post, was shut down on Sunday over “similar systemic risk” to SVB.

SVB and Signature are the second- and third-largest bank failures in U.S. history, respectively, with combined assets in excess of $300 billion. Depositors will be made whole, even deposits greater than the $250,000 covered by FDIC insurance. “Federal Reserve also said it is creating a new Bank Term Funding Program aimed at safeguarding institutions affected by the market instability of the SVB failure,” according to CNBC.

Investment holdings at SVB, however, are wiped out. “When the risk didn’t pay off, investors lose their money. That’s how capitalism works,” Biden said in his national address on Monday.

That’s what happened with Lehman Brothers, too, in 2008, before bigger faults were discovered and Washington went into Bailout All the Things Mode. This new crisis might just be getting started.

What went wrong? In a word: Inflation. In a few more words: The higher interest rates needed to combat inflation smashed the cheap-money expectations that SVB’s bond portfolios required. Other sectors of the economy that have become addicted to historically low interest rates include high-tech, particularly startup firms, and the housing market.

“I would be surprised if there weren’t other things that break. Maybe not directly related to the problems of SVB, but to some degree we’re already seeing breakage in terms of things like weakness in the housing market, other areas that are clearly in recession in the economy, even if we’re not in an overall recession,” warned Schwab’s chief investment strategist, Liz Ann Sonders, on Monday.

It’s been one helluva morning, and that’s just in the banking sector. Looks like it’s time to haul out the Chart of Doom that surfaced on the internet back in 2008.

Laugh. It beats crying — unless you’re one of those Etsy sellers who hasn’t been paid in days.

On Sunday, Etsy reported that “a small group of sellers… had their payments delayed on Friday” due to impacts from SVB’s implosion. “We expect we will be able to begin processing these payments as soon as tomorrow, March 13,” but as of this writing, there haven’t been any updates. Some sellers have been forced to put their stores in “vacation mode” because, without any money coming in, they can’t afford to pay for shipping on wares going out to customers.

So it isn’t just the big players getting hurt in the Biden economy, but there could be worse to come.

Inflation remains stubbornly high, due in large part to the Fed being both slow and timid in its rate hikes. We have a dismal 1981 inflation rate (properly figured) and a good-times 1995 Federal funds rate. Something’s gotta give.

Nevertheless, Goldman Sachs analysts wrote in an investor’s letter on Sunday that “we no longer expect the FOMC to deliver a rate hike at its March 22 meeting with considerable uncertainty about the path beyond March.” If the problems we’re seeing in the banking system take a toll on consumer and investor confidence, then the Fed will do what it always does in that situation: easy money, baby!

But easy money during an inflationary period just adds fuel to the fire.

“We’ve made strong economic progress in the past two years,” Biden said Monday. The RNC Twitter account responded with a few inconvenient truths: “When Biden took office, inflation was at 1.4% and gas was $2.39/gal. Today, inflation is at 6.4% and gas is $3.47/gal.”

And that was before the big bills starting coming due for three years spent shutting down and re-regulating the economy while printing up trillions in funny money.

I could say “I told you so,” gentle reader, but you were telling me, too.