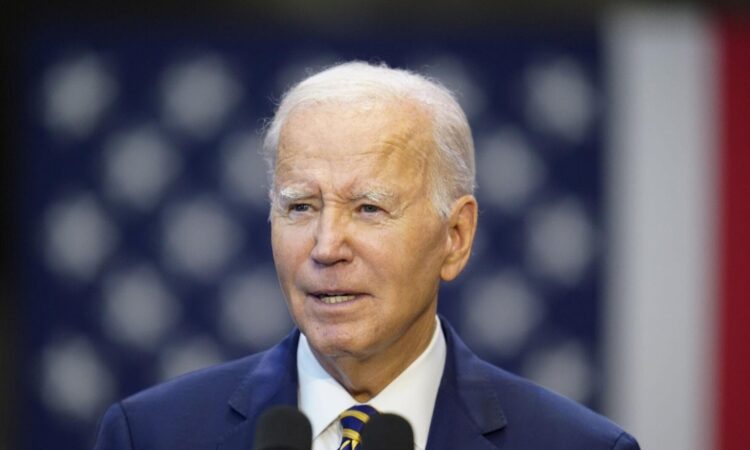

The Biden administration has introduced a new rule that could greatly improve financial access for millions of Americans. By removing unpaid medical bills from credit reports, this change aims to make it easier for people to access credit and improve their financial standing.

Medical debt has been a major obstacle for many, lowering credit scores and making it harder to get loans or affordable interest rates. This new rule is expected to erase around $49 billion in medical debt, benefiting over 15 million people and giving their credit scores a much-needed boost.

With medical debt no longer affecting credit reports, many people will see their credit scores increase by about 20 points. This small change could make a big difference, especially for those trying to buy a home. Experts estimate that this could lead to 22,000 additional mortgage approvals each year, helping more people enter the housing market.

As more people qualify for home loans, the real estate market could see significant growth. This not only benefits buyers but also helps the economy by creating more transactions and revitalizing communities.

This rule also addresses the connection between healthcare costs and financial stability. Unexpected medical bills often lead to debt and lower credit scores, especially for marginalized communities. By removing this burden, the administration is helping to promote fairness and give more people access to financial opportunities.

In the long run, higher credit scores mean better loan terms, lower interest rates, and more financial options. This could make it easier for individuals, especially in underserved communities, to build wealth and improve their financial outlook.

To make the most of this change, financial institutions will need to educate consumers about how it affects their credit and how to use their improved scores wisely. Resources like workshops and financial advice can help people take full advantage of the opportunities this rule provides.

Young adults, in particular, could benefit from this shift. With higher credit scores, they’ll find it easier to buy homes, which can provide stability for their families and boost the economy.

In summary, the Biden administration’s decision to remove medical debt from credit reports is a significant step toward reducing financial barriers. It offers millions of Americans a chance to improve their credit, access homeownership, and enjoy a brighter financial future, while also strengthening the broader economy.